Maximizing Your Economic Impact Payment

Economic Impact Payments are part of the CARES Act and designed to help stimulate the economy and could help you combat the economic effects of the COVID-19 pandemic. If you're one of millions of Americans scheduled to receive payment, there is some important information you should know.

Payment Eligibility & Status

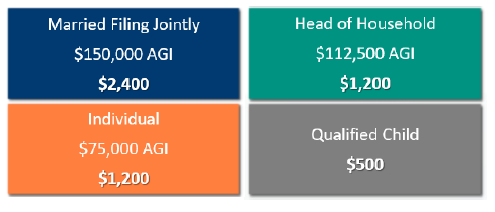

As part of the recent CARES Act, many Americans will receive Economic Impact payments, based on information from taxes filed in 2018 and 2019. Review the typical eligibility guidelines and visit irs.gov/coronavirus to check your economic impact payment eligibility and status.

What's the best way to spend your payment?

Everybody's situation is different right now. Depending on your situation, you might use your Economic Impact Payment for priority expenses, emergency savings, or debt reduction.

Here are some important things to consider, and resources to help you.